Financial Progress Notes

As a patient and grateful family member to patients, I have a special admiration and affinity for physicians. After years of financial planning with physicians, I have found we have a lot in common. Though physicians strive for physical well-being and planners for financial well-being, there are a number of parallels in our approach. Both the physician and financial planner identify and prioritize goals, gather and analyze data, diagnose problems and needs, prescribe and implement solutions, monitor progress and make adjustments as needed.

With planning, our communications endeavor to be concise and meaningful. Time is always an issue, but it is also the factor you would like to use to your advantage, and have on your side.

A text book may define financial planning as the process of setting goals and priorities, evaluating current and future needs with your resources, assessing cash flows and future retirement withdrawal plans, and determining the distribution of your estate. However, what it really means is how will you purchase a home, provide education for your children, make the car payment, take that vacation, expand your business, and have the confidence in your retirement income. This partial list does make up common objectives all of us share. Yet, it is surprising how few have a specific financial plan in place to enable the desired outcome. Many of the most accomplished professionals do not achieve all they had hoped for, or paid a far greater price in money and time because they didn’t have the map.

The traditional components of financial planning are:

- Financial Planning: (process and overview). This will include an in depth profile, data gathering, goal setting, analysis, and considerations to implement.

- Investments: This is to understand broadly what various assets are, how they work, when they are used, the risks and potential reward that each has, and how they are structured.

- Tax Management: Tax advice is to be received from your tax professional, but you can plan and take advantage of tax strategies, investment selection, account structure.

- Risk Management: Risk is not only present in investment selection, but in our ability to create income, and to ward off claims by creditors in personal and business affairs. Asset protection and insurance techniques are among the tools employed.

- Retirement planning: All sources of income are analyzed and monitored to provide a consistent, tax efficient stream of income, that may last throughout life.

- Estate Planning: This considers protecting assets for the current owners/trustees as well as the desired distribution of assets to estate/trust beneficiaries.

The bottom line is that planning works! It can enable you increase resources and make better use of the assets you have. All of these components will be addressed in greater detail in future blogs with a special focus on the physician sensitive areas of Cash Flow Planning, Tax Efficiency, and Asset Protection.

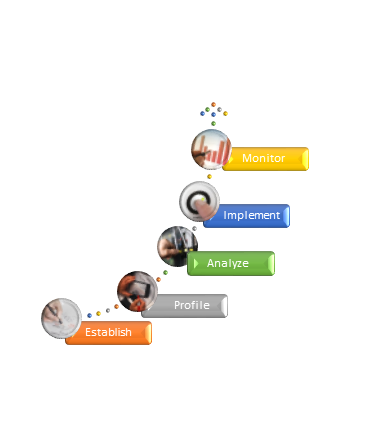

Financial Planning Process

Track Cash Flow, Net Worth, Debt Mgt, Taxes, Goals

Specific Strategies: Debt, Tax, Risk Mgt, Retirement, Estate Planning

Technology to Calculate, Test, and Confirm Plan

Gather Data to Develop Strategy

Set and Prioritize Goals/Issues