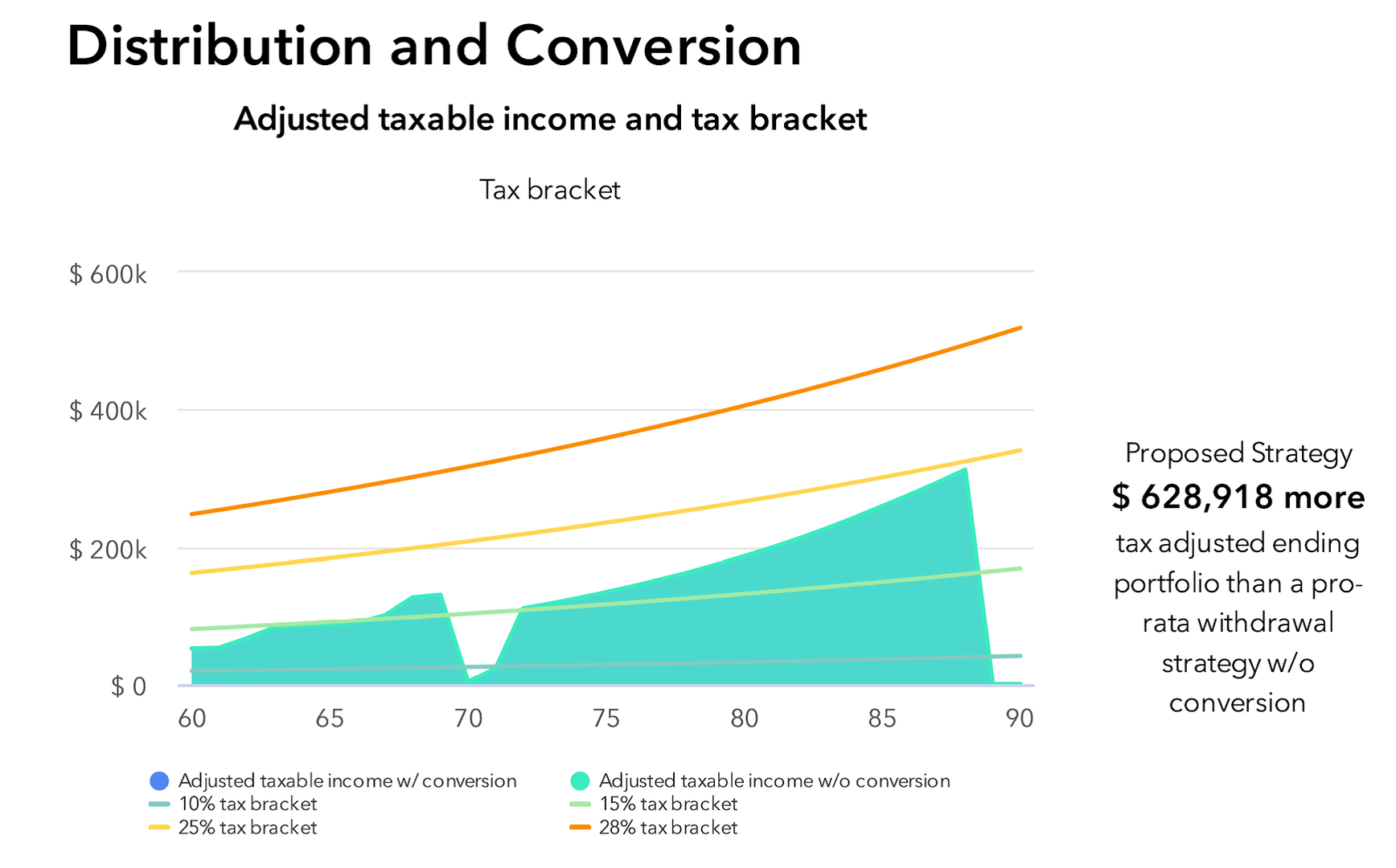

These past few years have brought political, economic, social, and medical conflicts in rapid succession. We have also had three legislative acts to promote tax, retirement, and economic stimulus in these years. Coincidence or not, each of these Acts have provided additional incentive to review a number of Roth strategies that may improve tax outcomes.

View More